how to lower property taxes in california

See If You Qualify For IRS Fresh Start Program. Web California doesnt offer many special property tax breaks for seniors although they can claim the standard California write-offs other homeowners are entitled to.

Understanding California S Property Taxes

If a homeowner feels that there was an incorrect valuation of their home they may be able to reduce their California.

. Ad Based On Circumstances You May Already Qualify For Tax Relief. Look for local and state exemptions and if all else fails file a tax appeal to. As a result one of the most effective strategies to lower your total tax burden is to lower the assessed value of your homein.

Web To reduce your property taxes in a few clicks do the following. Begin your appeal process by filing an Assessment Appeal Application Form BOE-305-AH which you can obtain from. Web It does not reduce the amount of taxes owed to the county In California property taxes are collected at the county level.

Web How can I lower my property taxes in California. There are a myriad of others. Web This video covers how property tax is calculated and how you can pay a lower overall property tax.

Web How can I lower my property taxes in California. Number of Inherited Properties Likely to. Senior Tax Credit If you are a.

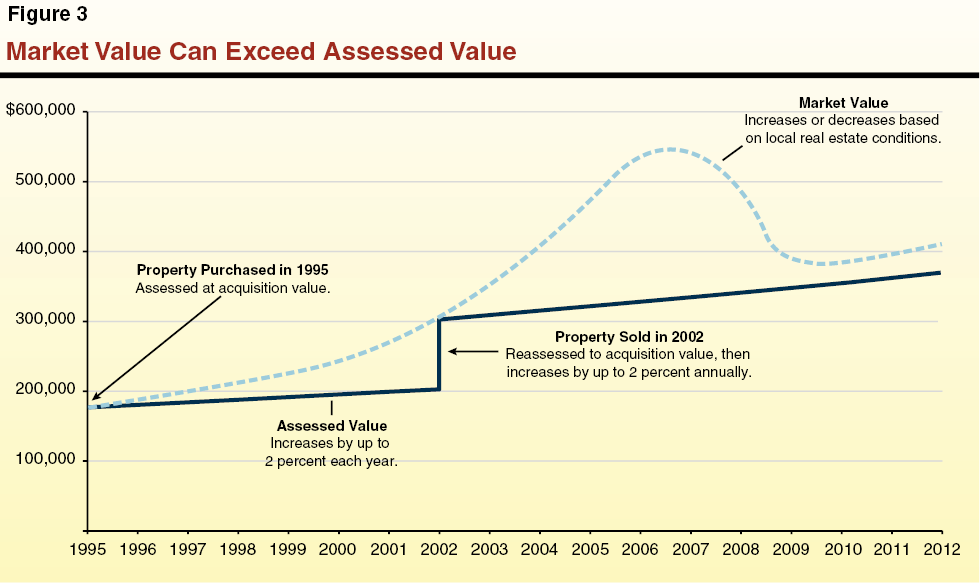

You can get your. Web It has a ceiling of 2. If you believe your home is assessed at a higher value than it should be you can file an appeal.

Select the Property Tax feature Answer our questions regarding your property Follow the. ASSESSMENT INFORMATION Christina Wynn Assessor 3636 AMERICAN RIVER DRIVE SUITE 200 SACRAMENTO CA 95864-5952. Applicants must file claims annually with.

Web The average effective property tax rate in California is 073 compared to the national rate which sits at 107. Web Give the assessor a chance to walk through your homewith youduring your assessment. Web Up to 25 cash back The San Francisco County Assessor placed a taxable value of 900000 on their home.

Web How Do I Reduce My Property Taxes. How can I lower my property taxes in Illinois. Web California Property Tax Appeal The County Assessor Makes Mistakes Mistakes in Size Value and Location Increase in Assessed Value Cannot Exceed 2.

Web All homeowners who use their property as their primary residence can apply for a property tax exemption of up to 7000 off the assessed value. Exemptions of 7000 are available to California real estate owners. By reducing the assessed value by 7000 your yearly taxes are reduced.

Free Case Review Begin Online. Web For a home owned this long the inheritance exclusion reduces the childs property tax bill by 3000 to 4000 per year. Access your DoNotPay account Open our Property Tax feature Provide the necessary answers Follow the.

Web Steps to Appeal Your California Property Tax. Web One way to reduce your property taxes is to appeal your assessment. Web To lower your property taxes in a few clicks log in to DoNotPay and follow these steps.

If the tax rate is 1 they will owe 9000 in property tax. By the time you are already paying a certain amount its. Web Steps to Appeal Your California Property Tax Begin your appeal process by filing an Assessment Appeal Application Form BOE-305-AH which you can obtain from.

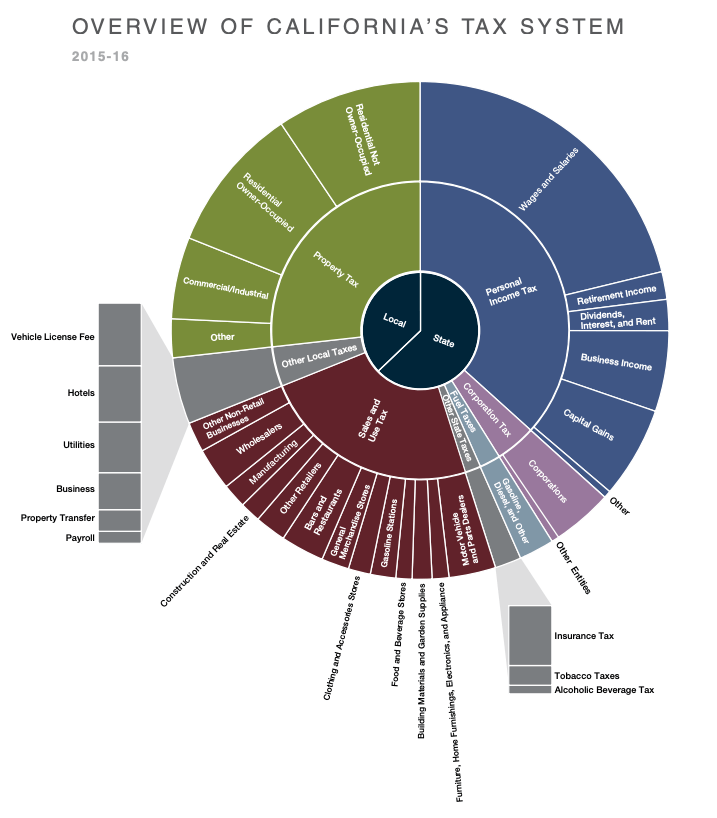

Web The following are 10 ways to lower taxes that are frequently overlooked by even the most sophisticated California commercial property owner.

Property Tax Process Mendocino County Ca

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Understanding California S Property Taxes

Riverside County Ca Property Tax Calculator Smartasset

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Understanding California S Property Taxes

Understanding California S Property Taxes

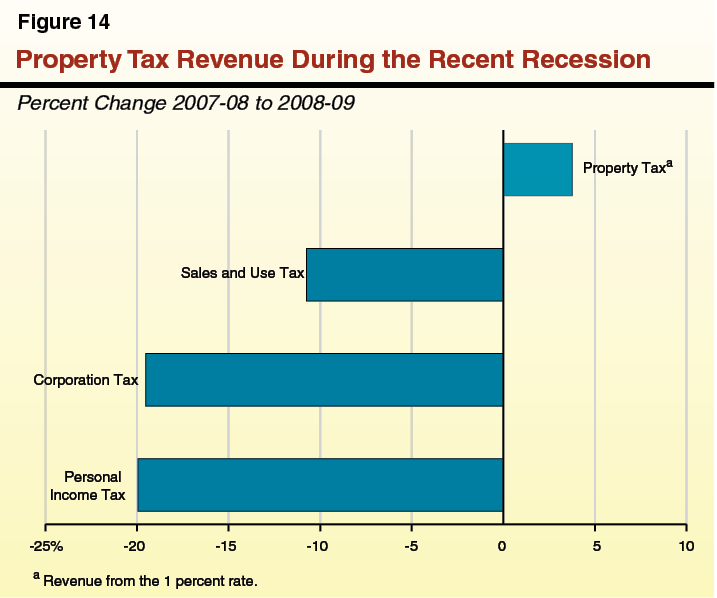

Prop 19 Would Make Changes To California S Residential Property Tax System California Budget And Policy Center

Understanding California S Property Taxes

State Corporate Income Tax Rates And Brackets Tax Foundation

What Is A Homestead Exemption And How Does It Work Lendingtree

Understanding California S Property Taxes

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

Deducting Property Taxes H R Block

Understanding California S Property Taxes

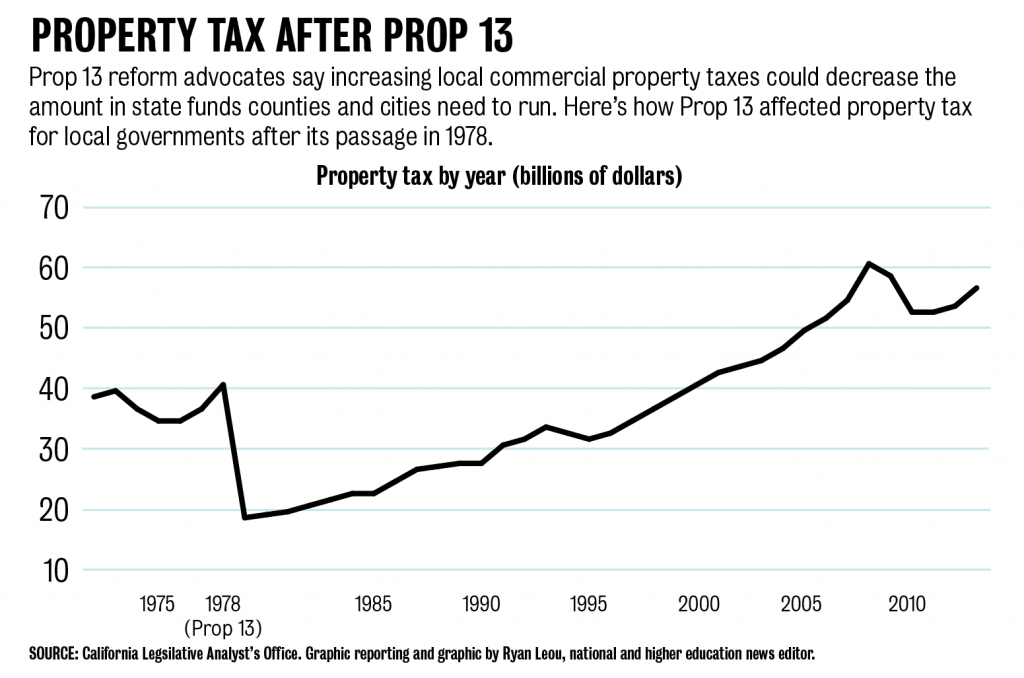

Ucsa Campaign Aims To Reform Prop 13 To Increase Uc Funding Daily Bruin